Philip Hergel

Senior Quantitative Analyst

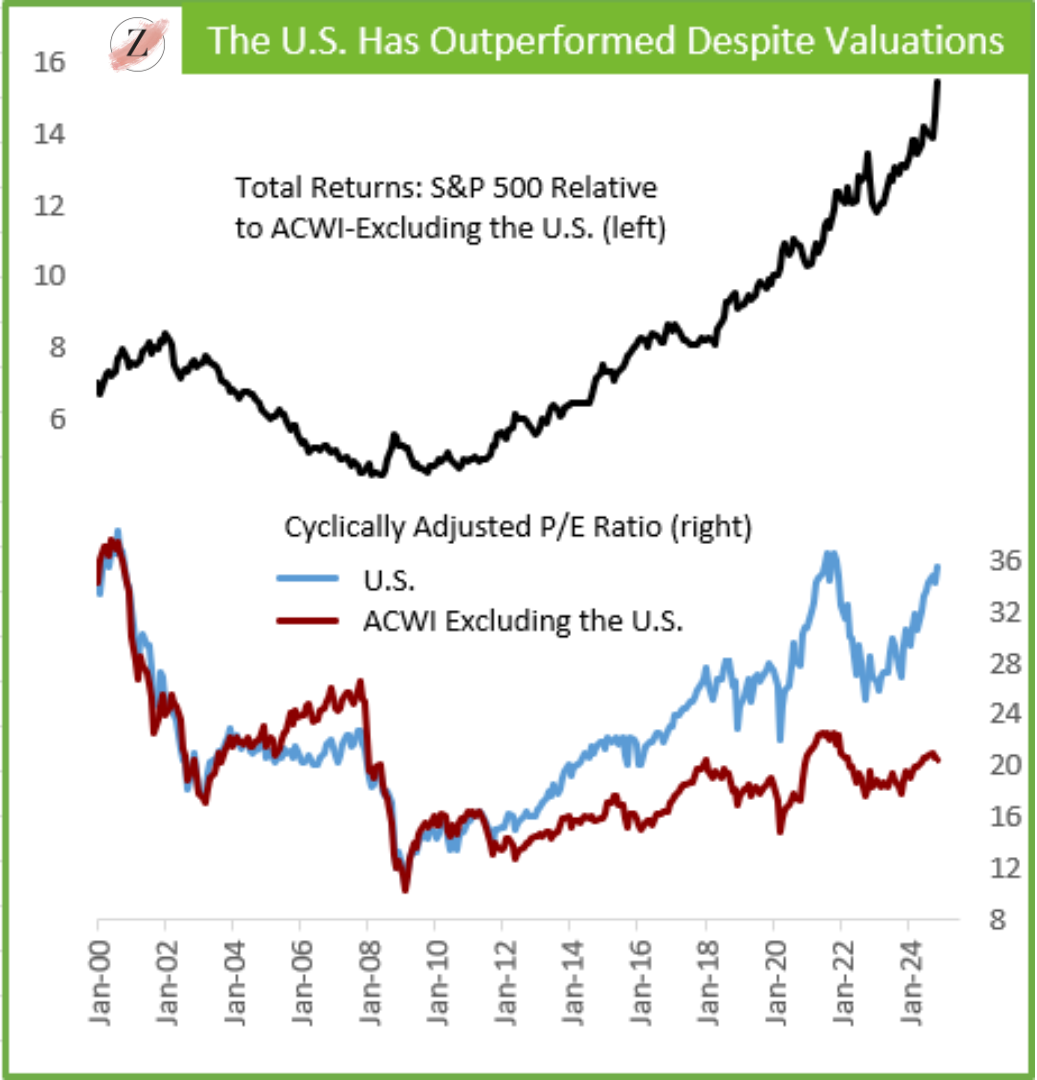

“I think there are some groups of stocks that are highly vulnerable because they’re in cuckoo land in terms of valuations.” These words from the controversial but always entertaining Marc Faber1 could not be more succinct given current equity market conditions. The post-pandemic rally in global stocks has the All-Country World Index (ACWI) up almost 150% from the lows in 2020. The S&P 500 has been even stronger over the same timeframe leaving stocks in expensive territory. Some would argue that valuations don’t matter because global stocks have been expensive for years and they keep marching higher. Further, the S&P 500 is especially overpriced relative to the rest of the world according to numerous indicators including the Cyclically Adjusted Price-to-Earnings Ratio (CAPE2), but the U.S. market has generally outperformed since the end of the 2008/2009 financial crisis (Chart 1). It’s important to note that valuations should not be looked at in isolation. Sometimes higher valuations are warranted by higher growth prospects.

Chart 1.

However, disregarding extremely high equity valuations as a valid reason for caution about the outlook for future stock prices can be risky. There’s a saying that the stock market tends to go up like an escalator, but it goes down like an elevator, and this can be especially true when equities are in expensive territory. For those of us who were investing in the late 1990s during the twilight of the technology frenzy, we remember all too well as sentiment turned negative and very stretched valuations contributed to the dot.com bubble becoming the dot.bomb bust. Stretched valuations didn’t cause the collapse, but they did make the decline more painful.

VALUATIONS Have an inflation problem

Let’s take a step back and first explore what we mean by expensive. Equities and equity markets are typically evaluated using some form of price-to-earnings ratio (P/E ratio) such as the CAPE mentioned above. These measures simply indicate how much an investor is paying for that company’s future expected earnings. What really matters in terms of valuations is not so much the absolute level of the ratio, but rather where the ratio stands relative to its own history or when compared to other similar assets. As already shown in Chart 1, the S&P 500 is clearly expensive relative to its history and equity markets in the rest of the world.

Chart 2.

A more fundamental way to consider valuations for an equity market is to compare the total value, or the “market cap” relative to other measures, such as the economy, or other assets. In the mid-1980s the market cap of all the companies publicly traded in the U.S. was roughly equal to half the size of the economy as measured by nominal GDP. Currently, the equity market is twice the size of the economy – a fourfold increase. Similarly, in the mid-1980s the total market cap of equities would buy 45 million average-priced American houses. Today the market could buy 176 million homes. Relative to the Consumer Price Index’s typical basket of goods, U.S. equities are too expensive to describe in words, so we’ll let Chart 2 do the talking. All this to say, alternative measures of U.S. equity valuation also show conditions are stretched.

Past Returns Are No Guarantee of Future Results

The risk associated with higher equity valuations is that the market becomes vulnerable to a decline. Valuations can be considered the price of risk. When stock valuations are high, risk is expensive and other asset classes like cash and bonds might be more attractively priced. Conversely, low valuations mean equity risk is on sale so it might be an opportune time to buy it, assuming of course it’s not cheap for a reason such as poor company fundamentals or a negative outlook for the sector.

In fact, empirical evidence clearly indicates that higher valuations to start tend to result in lower subsequent returns over the long run (Chart 3). There are several reasons why this is the case:

For a stock to be expensive, this implies the price is too high relative to the company’s future expected cash flows. Put another way, investors are expecting high future growth and have paid a premium for that prospect. In reality, however, future growth can fall short of overly optimistic expectations, leading to selling shares and downward pressure on the stock price.

An expensive stock implies its share price has been pushed up by previously high demand. Similar to sentiment indicators being contrary, if everyone owns the stock, there’s no one left to buy it and push the price even higher. As demand dries up one can expect the share price to fall.

Expensive equity market conditions can result in lower future returns for numerous reasons, and Chart 3 displays that this negative correlation has persisted over a very long period of time.

Valuations Are NOT A Timing Tool

While it’s true that global equities can be considered expensive currently, it’s also true that expensive conditions can persist for a long time. An investor who exits an expensive market early could miss out on substantial performance by exiting too soon. For example, the NASDAQ composite of technology stocks was first identified as expensive around 1997-1998 but the index went on to double over the next few years.

The example of the NASDAQ also highlights an important result; sometimes individual stocks are expensive for a very good reason – the economic outlook for that company is extremely positive. There are many examples of companies that “grew into” their high valuations and survived and thrived as the technology bubble burst. Microsoft, Amazon, Apple and many more all had price corrections in the early 2000s but it paid off to maintain positions in the years that followed as earnings soared. The winners in the aftermath of the tech bubble were all associated with the disruptive technology of the internet. Today, artificial intelligence is the disruptive technology. Although some companies are trading at high valuations, some will come out as the winners and will likely grow into their stretched valuations. The ability to identify the eventual winners based on sound fundamental analysis is key to portfolio performance.

Lastly, relatively high valuations in the broad market do not preclude relatively attractive value in certain sectors or companies within that broad market. High valuations indicate risk, so it becomes even more important to be able to analyze and quantify the risk / reward tradeoff for particular assets, and clearly underscores the need for active asset management during expensive market conditions.

Bottom Line

Chart 3

Download this market perspective.

Valuations help guide investors’ directional bias by identifying future opportunities and evaluating risk and return expectations. Even though equity markets are stretched, these conditions alone do not warrant underweighting stocks in a balanced portfolio. Valuations are a terrible tool for timing the market and history shows that sometimes valuations improve as earnings expand. It’s important to be aware of all types of risks when making investment decisions and valuations are just one to consider.

A Final Note on Values

The results of the 2024 U.S. presidential election remind us of the Native American story The Two Wolves, in which a grandfather tells his grandchild about the two wolves in battle in all of our hearts. The first is the wolf of compassion, love, understanding and generosity. The other is the wolf of cruelty, hate, fear and selfishness. When the grandchild asks which wolf wins, his grandfather replies, “the one you feed.” At Zevin Asset Management, we choose to feed the compassionate wolf. Despite the results of November 5, we continue to advocate for social justice in efforts to move the needle towards a sustainable, inclusive and equitable world. Our values won’t change, and we are grateful to our clients, who share our values and allow us to continue this important work.

1. Fund manager investment advisor and publisher of the Gloom, Boom & Doom report.

2. The CAPE, also known as Shiller’s P/E is a long-term measure of equity valuation which smooths out fluctuations in corporate earnings.

Disclosures: Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. This communication is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. All expressions of opinion are subject to change. You are cautioned not to place undue reliance on these forward-looking statements. Any dated information is published as of its date only. Dated and forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any dated or forward-looking statements.